The U.S. technology job market in 2025 is both thriving and strained. On the surface, the numbers tell a story of strength:

- In January 2025, there were more than 476,000 active open tech roles nationwide.

- Employers posted an additional 51,000 new jobs that month.

- The workforce also saw a net gain of 228,000 technology occupations, marking the second consecutive month of growth.

At the same time, the Bureau of Labor Statistics (BLS) reported a total of 7.2 million job openings across the U.S. by July 2025, a number little changed from the previous month. This creates a paradox: despite widespread demand, many employers still cannot fill roles quickly enough, and some job titles remain below pre-pandemic levels.

This imbalance—rising demand paired with persistent scarcity of specialized skills—is what makes staff augmentation and developer-on-demand models increasingly relevant.

At the same time, the Bureau of Labor Statistics (BLS) reported a total of 7.2 million job openings across the U.S. by July 2025, a number little changed from the previous month. This creates a paradox: despite widespread demand, many employers still cannot fill roles quickly enough, and some job titles remain below pre-pandemic levels.

This imbalance—rising demand paired with persistent scarcity of specialized skills—is what makes staff augmentation and developer-on-demand models increasingly relevant.

The Long View: Strong Growth, High Turnover

Looking ahead, the trajectory of the U.S. tech workforce is clear. Projections from BLS and Lightcast suggest that:

- The tech workforce will grow at twice the rate of the overall U.S. workforce over the next decade

- From 2024 to 2034, the industry will require an average of 352,000 replacement workers per year, driven by retirements, career shifts, and reskilling.

- By 2035, this will translate into millions of job changes, adding significant churn even amid growth.

This presents a dual challenge for organizations:

- Expansion pressure — as new digital initiatives demand larger teams.

- Replacement pressure — as roles turn over at a faster-than-average pace.

In addition, emerging areas such as artificial intelligence, machine learning, data science, and cybersecurity are creating entirely new categories of demand. These are fields where the required skills didn’t exist at scale just a decade ago, and supply has yet to catch up.

Why Staff Augmentation is on the Rise

Traditional hiring is often too slow for today’s realities. A single recruitment cycle for a specialized developer can take 8–12 weeks or more, not including onboarding. Meanwhile, projects may need immediate support to hit deadlines or adapt to market changes.

Staff augmentation and developer-on-demand models solve this gap by offering:

- Access to scarce expertise

- AI engineers, cybersecurity analysts, and DevOps specialists are among the most difficult roles to fill.

- Augmentation provides a pipeline to vetted professionals in these niches.

- Speed and flexibility

- Developers can be onboarded in days instead of months.

- Teams can scale up for peak demand and scale down when projects close, avoiding the costs of underutilized staff.

- Risk management

- Employers reduce the risk of long-term commitments in volatile markets.

- Augmentation enables project continuity even when internal teams face turnover.

- Blended collaboration

- Hybrid models allow external developers to integrate with in-house teams, ensuring knowledge transfer and continuity.

Surveys confirm this need: nearly 9 out of 10 IT leaders say they struggle to source qualified professionals. What once was a stopgap solution is fast becoming a standard operating practice.

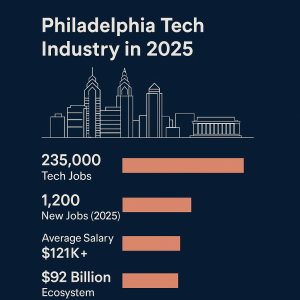

Philadelphia: A Regional Snapshot

The Greater Philadelphia region illustrates the opportunities and challenges of 2025.

- 235,000 tech jobs make it the 18th largest U.S. tech market.

- About 1,200 new roles are projected to be added in 2025.

- Average salaries exceed $121,000, an 11.8% increase since 2022.

- The ecosystem is valued at $92 billion, with strong support from 130 academic institutions feeding talent pipelines. (Axios, Nucamp)

Philadelphia also stands out in AI hiring, ranking 11th in the nation for AI job postings, accounting for 2.15% of national postings. Yet, like the broader U.S. market, the region continues to face shortages in specialized skills—making staff augmentation a critical strategy to support growth while sustaining momentum.

Adapting to an Evolving Market

The broader lesson from early 2025 is that tech work is expanding, but not evenly. Growth is strong, but demand is shifting faster than supply can adjust. Traditional hiring pipelines—already slowed by long recruitment cycles—struggle to keep pace.

Staff augmentation and developer-on-demand offer organizations:

- Continuity — keeping projects on track even during hiring lags.

- Specialization — tapping niche expertise when it’s needed most.

- Agility — scaling resources in line with project demands and market shifts.

- Capacity building — enabling in-house teams to learn alongside external specialists.

In a market defined by both rapid expansion and rapid turnover, these models provide a bridge between short-term project needs and long-term workforce strategies.

Closing Thought

The U.S. tech sector remains one of the fastest-growing parts of the economy, but it is also one of the most dynamic and fragmented. Employers face a landscape where demand outpaces supply, roles evolve quickly, and regional disparities persist.

For many organizations, the answer is no longer about choosing between hiring full-time or outsourcing entirely. Instead, it is about adopting flexible workforce solutions—including staff augmentation and developer-on-demand—that allow them to remain agile, innovative, and competitive.

As 2025 unfolds, the ability to adapt to this shifting workforce reality may be the single most important differentiator for organizations pursuing digital growth.